Financial functions let you calculate things like interest, payments, and future values.

One of the most useful financial functions, the PMT function, calculates the payment for a loan based on periodic payments and a constant interest rate. For example, if you are taking out a $10,000 car loan at 8% interest and know that the loan would have to be paid off in four years, you could use the PMT function to calculate that the monthly payments for such a loan would be $244.13.

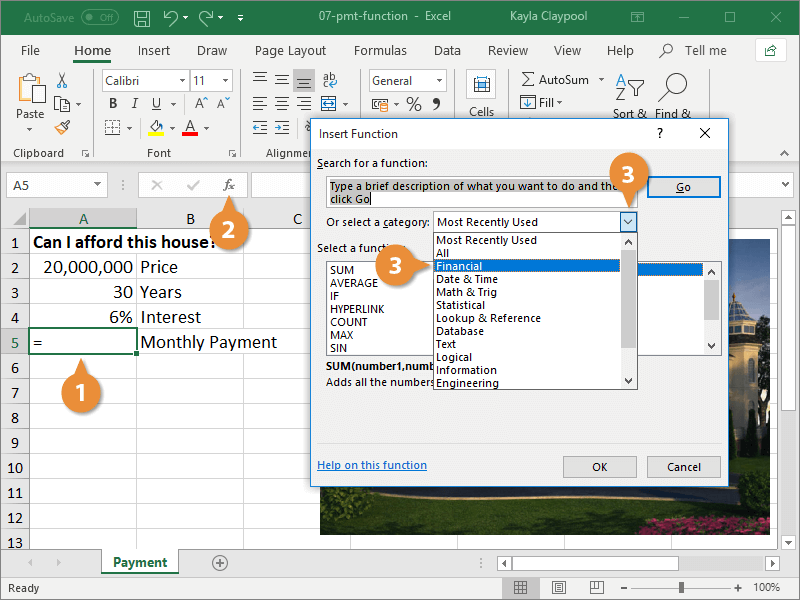

- Select the cell where you want to add the result of the payment function.

- Click the Insert Function button.

The Insert Function feature helps you select, enter, and edit worksheet functions.

- Select Financial from the list of function categories.

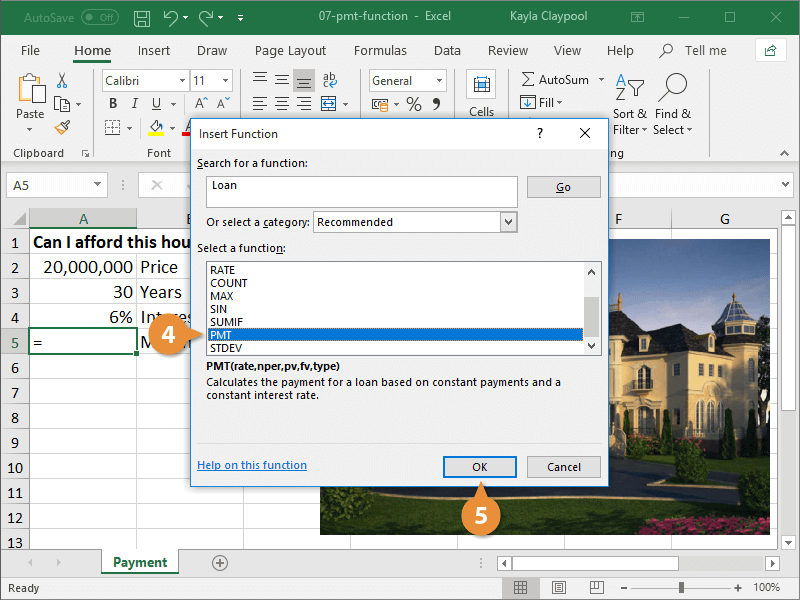

- Select the PMT function.

A description appears below the list describing what the PMT function calculates.

- Click OK.

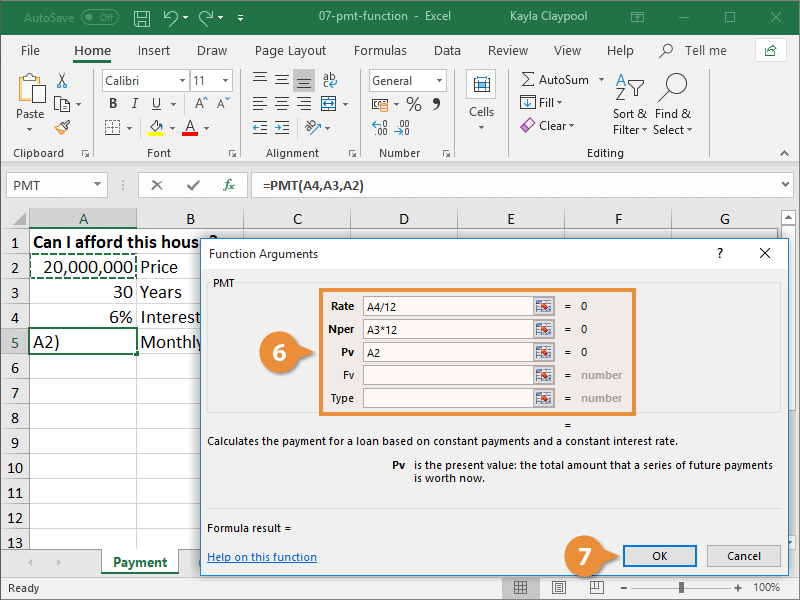

- Fill in the function arguments.

Pay attention to the argument notes below the argument fields. These give details about what to enter for the argument.

The arguments in bold are required; the others are optional.

Instead of typing argument values, click in an argument field, then select a cell or cell range in the worksheet.

- Click OK when you’re finished.

The payment function calculates all the arguments and puts the result in the selected cell.